Managing your money

Managing money is the name of the game. In Ireland, this is something we know a lot about – and we’re very happy to share our knowledge.

It’s all a matter of balance. You need to balance your outgoings with the money coming in every week or month. Most people have a reasonable idea of what their regular income is. They’re less certain of what they’re spending and how savings can be made. That’s where an online family budget planner (such as the one provided by Ireland’s Competition and Consumer Protection Commission) can help.

Planners ask you to list what you receive and spend across a spread of categories. Everything, in fact, from groceries and clothing to travel, entertainment, school activities and many more items. Being prompted like this is valuable because it’s so easy to forget how many individual expenses we all juggle.

Once everything is listed, it’s easier to assess how things stand. You’ll see what are taking the biggest bites out of your household budget – and if you can see these, you can do something about them.

Alternatively, you could be even more radical by using a concept called ‘zero-based budgeting’. Rather than starting with all your existing expenses (an approach known as ‘incremental budgeting’), you begin with a blank sheet of paper and build your budget from scratch. Doing so lets you identify where you really need to spend money.

Sort out saving

When it comes to paying for other things – and especially the nice stuff like holidays, gifts and treats – your first stop should be your own funds. This means starting to save regularly is one of the healthiest financial habits you can develop. AIB is right with you if you want to start saving and offers a range of accounts that let you save in the way that suits you best.

For example, maybe you need the reassurance of knowing your money is instantly available. Expenses like car or house repairs have a habit of pouncing when they’re least expected. Having money to hand can take the sting out of emergency costs like these.

On the other hand, maybe you know there will be major expenses down the line – education fees or weddings for example. In this case, it’s probably better to save using an account that doesn’t let you dip into it too easily. With an online notice account, paying in is straightforward but you may need to wait a few days’ between applying to withdraw and actually receiving the money. This reduces the chance that impulse purchases will erode the nest egg you’ve been building up.

Managing and minimising costs

You can’t avoid paying for some things - food, heating, mortgage or rent for example. But while you can’t stop spending on these, you can pay less. Although shopping around may seem simple, surprisingly few people take the time to search for better value, even as the cost of living continues to rise.

Many companies load the highest costs on their existing customers and reserve the sweetest deals for new ones. So if you want to make savings while enjoying the same quality of service, shop around. In this regard, price comparison sites like bonkers.ie and switcher.ie can be real eye-openers.

A simple trick to control spending

A simple but effective savings technique is to decide how much you can afford to save, then transferring this amount via a Standing Order to your savings account as close to pay day as possible. When money isn’t in your current account, you may feel you have less and adjust your spending accordingly. Out of sight, out of mind...

AIB has all the tools you need to set this up online. Check out how we can support your savings.

Think long term – and tax free

The money you earn today can also benefit you many years from now. Retirement may seem a long way off but it’s never too early to think of investing in a pension. Besides having a bigger pension pot when you eventually retire, every contribution attracts tax relief equivalent to the tax you already paid on it.

Investing in a pension is the most tax-efficient way to save - and AIB can give you a clear idea of how well prepared you are for retirement and outline all the options available to you.

Manage your money: remember the 6P's

For the most part, managing your money is just a matter of simple commonsense combined with some self-discipline and awareness of your income and outgoings. Here’s a handy list to remind you what’s most important:

Prioritise: Use an expense tracker to list the must-pays, then decide how you want to use what’s left.

Pinpoint: Identify the precise level of your regular income and spending.

Plan: Create a plan that reflects your priorities – and stick to it!

Prepare: Be ready for unexpected expenses.

Put away: Even if it’s a small amount, establish a regular savings habit.

Pension: The state adds to any money you put into a pension. Invest and get free money!

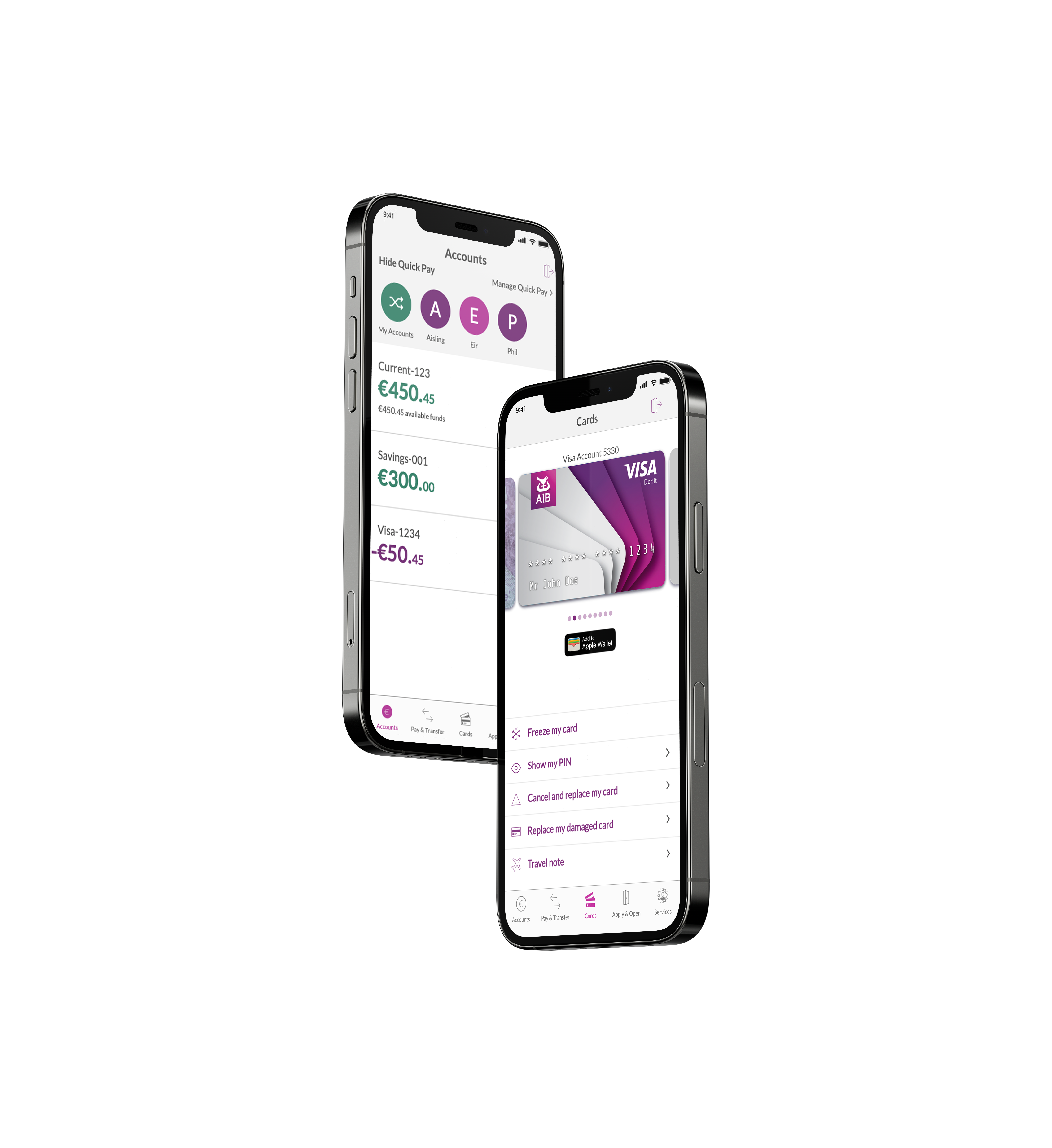

Manage better with the AIB Mobile Apps

If your smartphone is always with you, the AIB Mobile App is an incredibly powerful money management tool. From making payments and keeping track of account balances to opening an Online Saver or Personal Demand Deposit account, the app gives you real control anywhere, anytime.

More useful tools

Let's talk about spending

Tips on shopping around and saving

Planning gives you control

Plan how to handle your finances

Budgeting tool

Notice accounts

Consider keeping your savings separate

Cost of living support

To help you manage your money

Home Mortgage Regulatory Information

Allied Irish Banks, p.l.c. is an authorised agent and servicer of AIB Mortgage Bank u.c. in relation to origination and servicing of mortgage loans and mortgages. AIB Mortgage Bank u.c. is regulated by the Central Bank of Ireland.

| Lending criteria, terms and conditions apply. Over 18s only. Security may be required. |

| WARNING: If you do not keep up your repayments you may lose your home. |

| WARNING: You may have to pay charges if you pay off a fixed-rate loan early. |

| WARNING: The cost of your monthly repayments may increase. |

| WARNING: If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, which may limit your ability to access credit in the future. |