How it works

Online loans from €1000 approved in 3 hours

3 hour loan decision applies to fully completed

new personal loan applications processed within

3 hour 9am-5pm, Mon-Fri excl bank holidays.

Loans from €1000-€30.000*

Standard lending rate at 8.95% APR up to €50,000

For loans over that amount, contact your local

branch or call 0818 724 725

Take a break, with a loan repayment holiday

You can request to take a repayment break at a set time every year, e.g. at Christmas, so your annual loan repayments are spread over 11 months instead of 12.

No charge for unscheduled repayments

We won't charge you extra if you make a payment to your loan oustside of your normal scheduled repayment

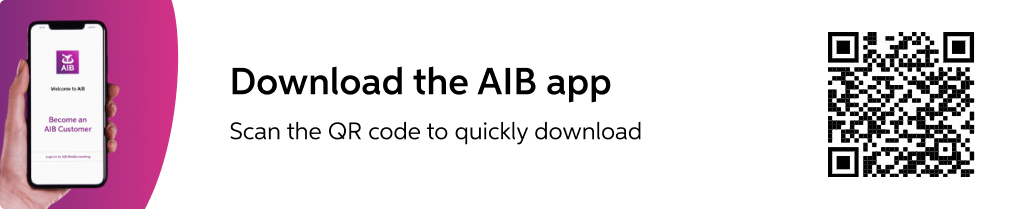

Manage your loan through the AIB app

Your're in control. Know exactly how many payments you've got left, when they'll be going out and how much they'll be for.

Help centre

-

How much can I borrow?

-

How do I apply for a loan?

-

When do I get my money?

-

What can I use the money for?